Costs associated with poor environmental and societal performance can be very large. Waste disposal feed, permitting costs, and liability costs can all be substantial. Wasted raw material, waste energy, and reduced manufacturing throughput are also consequences of wastes and emissions. Corporate image and relationships with workers and communities can suffer if performance is substandard. But how can these costs be quantified? This section will review the tools available for estimating environmental and societal costs and benefits. These include traditional concepts such as the time value of money, PV, PP, internal ROR, and other financial evaluation calculations. Nontraditional tools include methods for monetizing environmental costs that are hidden from normal accounting procedures. We’ll also touch upon less tangible costs and benefits that can still be monetized.

In general, traditional accounting practices have acted as a barrier to implementation of sustainable engineering projects because they hide the costs of poor environmental and societal performance. Many organizations are now giving more consideration to all significant sources of environmental and societal costs. The principle is that if costs are properly accounted for, management practices that foster good economic and societal performance will also foster superior environmental and societal performance (USEPA 1995c).

Estimates of Environmental Costs

It is generally recognized that in environmental and societal cost accounting, words like full (e.g. full‐cost accounting), total (e.g. total cost assessment), true, and life cycle (e.g. life cycle costing) are used to indicate that not all costs are captured in traditional accounting and capital budgeting practices. Among the easiest environmental costs to track are the costs associated with treating emissions and disposing of wastes. DC of pollution abatement are tracked by the U.S. Census Bureau and have been increasing steadily. Expenditures in 1972 totaled $52 billion (in 1990 dollars) and were projected to grow to approximately $140 billion (in 1990 dollars), or 2.0–2.2% of gross national product, in the year 2000 (for a review and analysis of these data, see United State Congress 1994).

Table 7.7 Pollutant abatement expenditures by US manufacturing industries.

Source: Data reported by US Congress (1994); original data collected by US Census Bureau. http://www.census.gov

| Industry sector | Pollution control expenditure (as % of sales) | Pollution control expenditure (as % of value added) | Capital expenditure (as % of total capital expenditure) |

| Petroleum | 2.25 | 15.42 | 25.7 |

| Primary metals | 1.68 | 4.79 | 11.6 |

| Pulp mill | 5.70 | 12.39 | 17.2 |

| Paper | 1.87 | 4.13 | 13.8 |

| Chemical manufacturing | 1.88 | 3.54 | 13.4 |

| Stone product | 0.93 | 1.77 | 7.2 |

| Lumber | 0.63 | 1.67 | 11.1 |

| Leather products | 0.65 | 1.37 | 16.2 |

| Fabricated materials | 0.65 | 1.34 | 4.6 |

| Food | 0.42 | 1.11 | 5.3 |

| Rubber | 0.49 | 0.98 | 2.0 |

| Textile | 0.38 | 0.93 | 3.3 |

| Electric product | 0.49 | 0.91 | 2.9 |

| Transportation | 0.33 | 0.80 | 3.0 |

| Furniture | 0.38 | 0.73 | 3.4 |

| Machinery | 0.25 | 0.57 | 1.9 |

These expenditures are not distributed uniformly among industry sectors. As shown in Table 7.7, sectors such as petroleum refining and chemical manufacturing spend much higher fractions of their net sales and capital expenditures on pollution abatement than do other industrial sectors. Therefore, in these industrial sectors, minimizing costs by preventing wastes and emissions will be far more strategic an issue than in other sectors.

EXAMPLE 7.5 POTENTIAL POLLUTION CONTROL COSTS FOR GREENHOUSE GASES

Estimate control costs for greenhouse gases for an electricity generating unit (EGU) or power plant) as a percentage of sales revenues. Assume that (i) the EGU uses coal as a fuel and converts the heat of combustion of coal into electricity with 35% efficiency, (ii) the heating value of coal is 10 000 BTU/lb, (iii) coal is 85% carbon, (iv) carbon costs $20/T to capture and sequester, and (v) electricity can be sold for $0.10/kWh.

SOLUTION

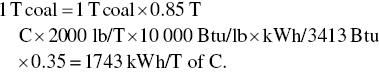

Basis:

The control costs are $20 for 1743 kWh electricity generation leads to 1743 kWh × $0.10/kWh = $174 in electricity sale. So the control cost is about 11% of sale.

Pollution abatement costs reported by individual companies both reflect these general trends and provide more detail about the magnitude and the distribution of environmental expenditures. For example, Tables 7.8 and 7.9 show the distribution of environmental costs reported by the Amoco Yorktown refinery and DuPont’s LaPorte chemical manufacturing facility (Heller et al. 1995; Shields et al. 1995). In the case of Amoco refinery only about a quarter of the quantified environmental costs are associated with waste treatment and disposal; the costs are summarized in Table 7.7 associated with removing sulfur from fuels, meeting other environmentally based fuel requirements, and maintaining environmental equipment were greater than the costs associated with waste treatment and disposal. This indicates that the magnitude of environmental costs is substantially greater than that reported in Table 7.7 and that these costs may be hard to identify.

Table 7.8 Summary of environmental costs at the Amoco Yorktown Refinery.

Source: From Heller et al. (1995).

| Cost category | Percentage of annual non‐crude operating costs |

| Waste treatment | 4.9 |

| Maintenance | 3.3 |

| Product requirements | 2.7 |

| Depreciation | 2.5 |

| Administration, compliance | 2.4 |

| Sulfur recovery | 1.1 |

| Waste disposal | 0.7 |

| Fees, fines, penalties | 0.2 |

| Total costs | 17.8 |

Table 7.9 Summary of environmental costs at the DuPont LaPorte Chemical Manufacturing Facility.

Source: From Shields et al. (1995).

| Cost category | Percentage of annual non‐crude operating costs |

| Taxes, fees, training, legal | 4.0 |

| Depreciation | 3.2 |

| Operations | 2.6 |

| Contract waste disposal | 2.4 |

| Utilities | 2.3 |

| Salaries | 1.8 |

| Maintenance | 1.6 |

| Engineering services | 1.1 |

| Total costs | 19.0 |

Leave a Reply